Inventory-sector dread is on the rise, with unique buyers getting to be the most bearish considering the fact that 2009, according to BofA International Analysis.

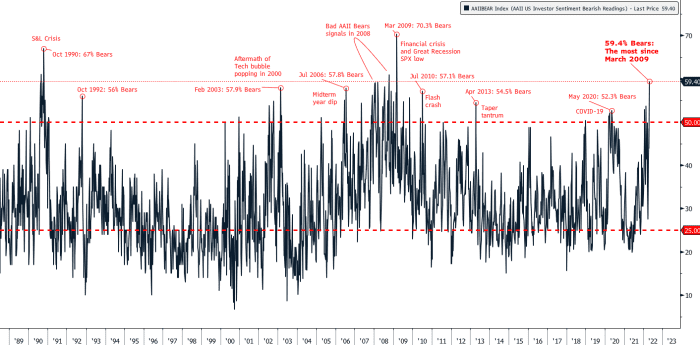

“Individual traders are running scared,” said Stephen Suttmeier, technical investigation strategist at BofA, in an April 29 notice. A bearish sentiment evaluate by the American Association of Specific Investors has “a capitulation reading of 59.4%, the maximum given that March 2009,” or all over the time the stock industry bottomed amid the global financial disaster, the note demonstrates.

BOFA World Analysis Take note DATED APRIL 29, 2022

An unsightly April for the U.S. inventory current market has deepened this year’s losses for important benchmarks as investors fret about soaring inflation and mounting interest prices. The Cboe Volatility Index

VIX,

was superior Monday afternoon at far more than 35, properly above its 200-day moving ordinary of all over 21.6, FactSet information exhibit, at last check out.

Though bearish sentiment could have some buyers searching for the S&P 500 to “bounce,” Suttmeier warned in the BofA report that indicators these types of as weakened credit-sector indexes point to the probable for it to see new lows this calendar year of about 3,800 to 4,000.

“This indicates that any rallies need to be bought,” he said in the report.

The S&P 500

SPX,

was down about 1.4% in Monday afternoon investing, just after getting into correction territory for the next time in 2022 on Friday, when it shut at 4,131.93, according to Dow Jones Market place Knowledge.

A correction is generally defined as a pullback of at minimum 10% — but not much more than 20% — from a modern peak. An exit from that territory occurs immediately after a rise of at the very least 10% from a correction reduced.

The S&P 500 and Dow Jones Industrial Ordinary also booked their worst April performance due to the fact 1970, even though the engineering-laden Nasdaq Composite

COMP,

noticed its ugliest April due to the fact 2000, the calendar year the dot-com bubble burst.

The bond sector has experienced this 12 months as properly.

Shares of the iShares iBoxx $ Large Produce Corporate Bond ETF

HYG,

and iShares iBoxx $ Expense Grade Company Bond ETF

LQD,

had been down in afternoon trading Monday, FactSet details present, at final examine. The share price of the iShares iBoxx $ Significant Produce Company Bond ETF fell 4.6% in April while the iShares iBoxx $ Investment decision Quality Company Bond ETF dropped 6.9%, FactSet information clearly show.

Go through: Why large-produce ETF outflows made this Jefferies strategist ‘a little nervous’

Meanwhile, spreads in the junk bond sector widened final thirty day period, according to facts from the ICE BofA US Superior Generate Index Option-Adjusted Unfold cited on the web site of the Federal Reserve Lender of St. Louis. Higher-yield spreads have been nearly 4 proportion points above comparable Treasurys at the finish of April, as opposed with all-around 3 proportion details at the get started of 2022, the knowledge demonstrate.

“Investors aren’t applied to looking at extraordinary losses in their bond portfolios, specially when fairness marketplaces are also declining sharply,” said Saira Malik, chief investment officer at Nuveen, in a be aware Monday. “We really don’t foresee this kind of simultaneous selloffs starting to be the norm, but fewer predictable correlations could become far more frequent as the Fed carries on its plan normalization and liquidity situations tighten.”

The Federal Reserve is aiming to overcome large inflation by tightening its financial coverage this 12 months through price raises and a reduction of its enormous equilibrium sheet. Traders assume the central bank to announce an additional price hike immediately after the summary Wednesday of its two-working day coverage meeting.

Read through: Farewell TINA? Why inventory-market place traders just can’t pay for to dismiss growing authentic yields.

“Bulls amongst particular person traders have become an endangered species,” claimed BofA’s Suttmeier.

More Stories

Five Tips For Dealing In the Stock Market

How To Learn Stock Investing – It’s Easier Than You Think

BSE (Bombay Stock Exchange) – Online Trading System