Sensation a little seasick? It is not just you. Apart from turning in a traditionally unsightly functionality above the 1st 4 months of 2022, shares have been uncommonly choppy.

“This has become a classic trader’s market place as spikes in volatility and progressively bearish headlines reverberate,” said Quincy Krosby, main equity strategist for LPL Economic.

Just take a glance at the tape: By means of Friday, the S&P 500

SPX,

experienced finished with a everyday acquire or loss of extra than 2% 12 situations so much in 2022 — 6 up and 6 down. That is compared with just 7 up or down moves of that magnitude in all of 2021, according to Dow Jones Current market Information.

With the exception of 2020, when pandemic-induced volatility produced 44 these kinds of times, the S&P 500 has now topped or is on keep track of to exceed totals for 2%-or-larger moves for each individual year stretching again to 2011.

The swings have felt even a lot more pronounced currently, with 3 of all those 2%-additionally sessions coming in the remaining 6 investing times of April. That features a 2.5% Thursday bounce that turned the index favourable on the week just before a 3.6% Friday plunge that pushed the substantial-cap benchmark again into a industry correction and still left it at its lowest near since Could 19.

Read: A rough 4 months for stocks: S&P 500 guides the worst start out to a 12 months given that 1939. Here’s what pros say you really should do now.

So what gives?

Earnings period definitely isn’t serving to easy the waters.

“As one particular usually sees in the late phases of a marketplace cycle, you get a ton of dispersion in earnings forecasts and bulletins,” stated Garrett DeSimone, head of quantitative investigate at OptionMetrics, in a cellphone interview.

Glance no even further than the market place reactions to success final week from Fb mother or father Meta Platforms Inc.

FB,

and Amazon.com Inc.

AMZN,

Stocks jumped Thursday, with the rally attributed in element to traders cheering improved-than-envisioned consumer numbers from Meta as the likely harbinger of a bottom for tech stocks. On Friday, shares slumped, with Amazon shares plunging additional than 14% for their biggest a single-day fall considering the fact that July 26, 2006, immediately after the e-commerce and tech huge noted its to start with quarterly reduction in 7 decades.

It underlines the late-cycle sample, in which volatility rises and unique stock efficiency is significantly less correlated, DeSimone defined.

And then, of course, there’s the Federal Reserve and its strategies to rein in inflation running at its best in a lot more than four a long time.

The Fed, which shipped a quarter share stage fascination rate maximize in March, is expected to deliver a uncommon fifty percent-position hike to the fed-resources rate when policy makers conclude a two-day conference on Wednesday. And traders have penciled in the chance of much more outsize rate will increase to appear, alongside with expectations for an intense wind-down of the central bank’s harmony sheet.

See: A fifty percent-position Fed fee hike noticed by now baked in the cake

The finish of the Fed’s bond-shopping for plan implies the industry has missing a “volatiity anchor,” wrote analysts at Lender of America, in their weekly Stream Present report on Friday, a growth they dubbed the “biggest tale of ’22.”

Disorderly costs and currency moves are also part of the backdrop, they explained, noting that market panics are “often associated with diverent central financial institution plan aims.”

That was on exhibit in excess of the previous 7 days as the the Japanese yen

USDJPY,

collapsed to a 20-yr minimal vs . the dollar and the euro

EURUSD,

edged nearer to parity with the buck. The Bank of Japan amazed buyers by not budging from its ultra-uncomplicated monetary plan, in distinction to a Fed set to supply its most aggressive tightening cycle in a long time.

In the meantime, inflation-cautious traders have dumped long-dated Treasurys, sending yields increased, whilst shorter-dated yields have risen in anticipation of Fed amount boosts. A flattening of the yield curve, which briefly saw the 2-calendar year rate higher than the 10-calendar year level in late March and early April, highlights jitters over the prospective for the Fed’s endeavours to tip the economic climate into economic downturn.

Genuine, or inflation-altered, Treasury yields are on the increase. That could supply generate-hungry traders an choice to stocks which is lengthy been lacking.

Examine: Farewell TINA? Why stock-market place buyers simply cannot pay for to dismiss growing serious yields.

The Russia-Ukraine war, which has despatched rates of oil and other commodities leaping, feeds volatility through the elevated inflation channel, which also feeds Treasury volatility, DeSimone explained.

The Cboe Volatility Index

VIX,

a evaluate of predicted 30-day S&P 500 volatiity, rose 18% around the earlier 7 days to 33.40 on Friday, over its prolonged-run regular beneath 20. It edged up additional to all-around 34 on Monday.

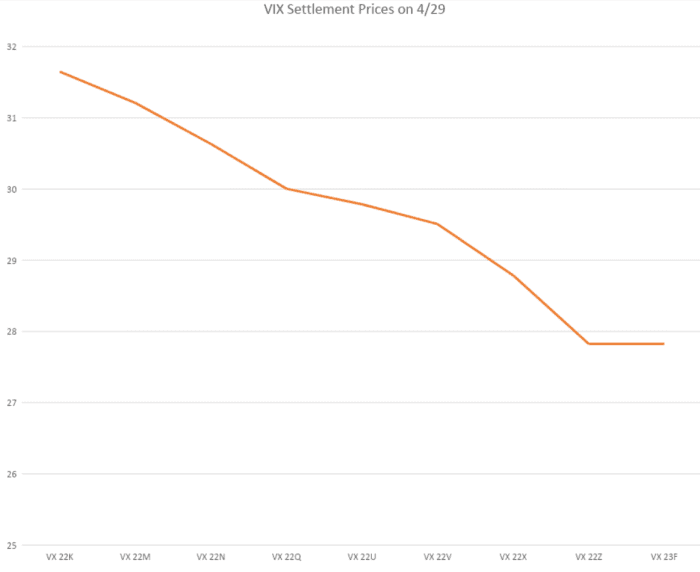

The VIX futures curve, which usually slopes upward, is is rather in a condition recognised as backwardation, with more time-dated contracts buying and selling under close to-phrase VIX futures.

OptionMetrics

But the incredibly front finish of the curve stays elevated, dipping under 30 only with the August contract. That signifies that investors count on current market to continue to be unstable at the very least into the early summer season with out a reversion to the signify, DeSimone stated — a shift that very likely displays uncertainty all over the size and scope of Fed level hikes. Relevant volatility in Treasurys, where by a selloff has sent yields soaring, has spilled about to equities, he stated.

The Fed has normally tried out to supply some clarity somewhat than to feed volatility, so traders may well be wanting for the Fed to clean the waters when it concludes its two-day coverage meeting on Wednesday, DeSimone stated.

Stocks, in the meantime, noticed a further choppy session on Monday, erasing steep losses to conclusion in constructive territory. The Dow Jones Industrial Typical

DJIA,

concluded with a obtain of all-around 84 details, or .3%, following falling 527 details at its session low. The S&P 500 gained .6%, whilst the Nasdaq Composite

COMP,

led the rebound with a achieve of 1.6% both the S&P 500 and Nasdaq traded at new lows for the yr during the session.

More Stories

New Jersey Attorney Ethics Investigations – The “Ten-Day Letter”

Five Tips For Dealing In the Stock Market

How To Learn Stock Investing – It’s Easier Than You Think