In excess of the past 3 months, 10 analysts have released their belief on NeoGenomics (NASDAQ:NEO) inventory. These analysts are generally utilized by large Wall Street banks and tasked with being familiar with a firm’s business to forecast how a inventory will trade about the impending calendar year.

| Bullish | Rather Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Rankings | 2 | 5 | 3 | ||

| Past 30D | 1 | ||||

| 1M Ago | |||||

| 2M Back | 2 | 1 | |||

| 3M Back | 2 | 2 | 2 |

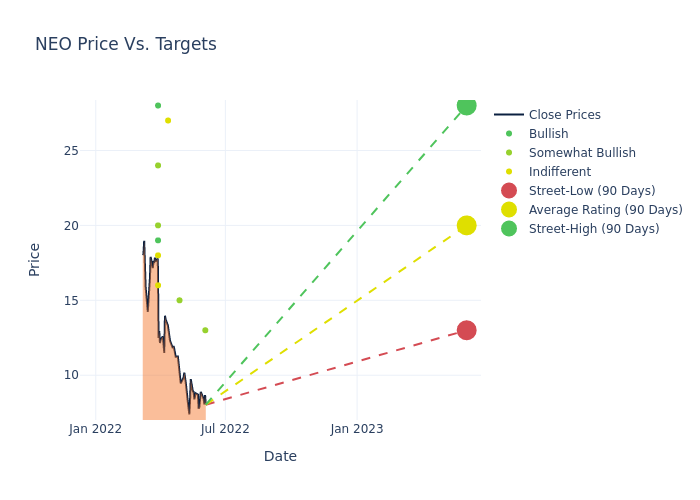

In the final 3 months, 10 analysts have made available 12-month value targets for NeoGenomics. The organization has an average selling price goal of $19.8 with a high of $28.00 and a very low of $13.00.

Under is a summary of how these 10 analysts rated NeoGenomics more than the earlier 3 months. The higher the number of bullish rankings, the far more optimistic analysts are on the stock and the larger the number of bearish scores, the far more adverse analysts are on the stock

This present ordinary has diminished by 36.58% from the former normal value target of $31.22.

If you are interested in subsequent tiny-cap stock information and performance you can begin by monitoring it listed here.

Benzinga tracks 150 analyst firms and experiences on their inventory anticipations. Analysts ordinarily arrive at their conclusions by predicting how considerably revenue a business will make in the upcoming, usually the impending five years, and how risky or predictable that firm’s revenue streams are.

Analysts go to business convention calls and conferences, study firm economical statements, and communicate with insiders to publish their scores on shares. Analysts normally fee just about every inventory once per quarter or every time the corporation has a important update.

Some analysts publish their predictions for metrics these types of as growth estimates, earnings, and profits to present more assistance with their ratings. When utilizing analyst rankings, it is critical to retain in intellect that inventory and sector analysts are also human and are only offering their opinions to traders.

If you want to keep observe of which analysts are outperforming many others, you can look at current analyst scores alongside withanalyst success scores in Benzinga Pro.

This write-up was produced by Benzinga’s automatic written content motor and reviewed by an editor.

More Stories

ECM – Tips For Managing Change Effectively

Taking Business to the Next Level With Statistical Consultancy Service

Women Entrepreneurs: How To Make Your Business A Success