Traders are anxious the stock market place may well be struggling with an earnings recession, likely leading to deeper losses immediately after the S&P 500 index just endured its worst week since March 2020.

“It’s fairly apparent that earning estimates are likely going to come down after climbing considering the fact that the to start with of the year,” stated Bob Doll, chief investment decision officer at Crossmark Worldwide Investments, in a phone job interview. “That’s what the market’s anxious about,” he explained, with investors questioning how “bad” earnings could grow to be in a weakening economy as the Federal Reserve aims to rein in surging inflation.

The Fed has develop into additional aggressive in its struggle to tame inflation right after it surged in Might to the highest stage because 1981, heightening fears that the central bank could induce a recession by destroying need with curiosity fee hikes aimed at cooling the overall economy.

Equity valuations have presently come down this 12 months as stocks were also expensive relative to the significant level of inflation and interest costs that are no extended in close proximity to zero, in accordance to Doll. He said shares keep on being below strain as room for the Fed to engineer a gentle landing for the U.S. economy appears to be narrowing, with increased problem more than slowing financial advancement and the expense of living continue to stubbornly substantial.

“People are concerned about the Fed needing to hike so considerably that it would press the economic system into a recession,” claimed Luke Tilley, main economist at Wilmington Rely on, in a cell phone job interview. “They’re not trying to induce a recession,” he explained, but they would induce one if essential to hold extended-term inflation anticipations from getting to be “unanchored” and “getting out of hand.”

What ever the chances of “a gentle landing” were being just before the client-value-index report on June 10 uncovered higher-than-envisioned inflation in Could, “they’re lesser now,” said Doll. Which is since the report moved the Fed, which is powering the curve, to turn into more aggressive in tightening its financial coverage, he explained.

The Fed announced June 15 that it was boosting its benchmark interest level by a few-quarters of a percentage issue — the major enhance considering that 1994 — to a targeted assortment of 1.5% to 1.75% to overcome the unanticipated surge in the price tag of residing.

That is significantly underneath the 8.6% rate of inflation witnessed in the 12 months via Might, as calculated by the shopper-rate index, with very last month’s improve in the value of dwelling driven by a rise in electrical power and foodstuff prices and bigger hire.

In modern quarters, providers in the U.S. have properly lifted charges to continue to keep up with their very own expense pressures, this kind of as labor, supplies and transportation, mentioned Doll. But at some point the buyer will take a pass, stating, “‘I’m not spending that anymore for that thing.’”

U.S. retail sales slipped in May for the first time in five months, in accordance to a report from the U.S. Department of Commerce on June 15. That is the exact same day the Fed declared its fee hike, with Fed Chair Jerome Powell subsequently holding a push conference on the central bank’s coverage choice.

“Markets really should be bracing for both equally weaker development and bigger inflation than the Fed is willing to acknowledge,” economists at Financial institution of America explained in a BofA World wide Study report dated June 16. “Chair Powell explained the economic system as continue to ‘strong.’ That is absolutely legitimate for the labor market, but we are monitoring pretty weak GDP development.”

Read: True property may nevertheless prosper as Fed fights inflation: it is tough to get ‘inflationary genie’ back in the bottle, claims this ETF portfolio manager

The BofA economists mentioned that they are now anticipating “only a 1.5% bounce back” in gross domestic products in the 2nd quarter, just after a 1.4% drop in GDP in the initial a few months of the 12 months. “The weakness is not broad sufficient or sturdy enough to contact a economic downturn, but it is regarding,” they wrote.

Shares, CEO self-assurance sink

The U.S. inventory current market has sunk this calendar year, with the S&P 500 index

SPX,

and engineering-significant Nasdaq Composite

COMP,

sliding into a bear sector. The Dow Jones Industrial Normal

DJIA,

is nearing bear-current market territory, which it would enter with a close of at minimum 20% under its 2022 peak in early January.

The Dow finished Friday bruised by its most significant weekly share fall given that Oct 2020, according to Dow Jones Market Details. The S&P 500 had its worst week because March 2020, when shares ended up reeling all through the COVID-19 crisis.

Providing pressure in the market place has been “so extraordinarily strong” that the chance of a sharp reversal is “ever present,” if only as “a counter-development rally,” stated James Solloway, chief marketplace strategist at SEI Investments Co., in a cellphone interview.

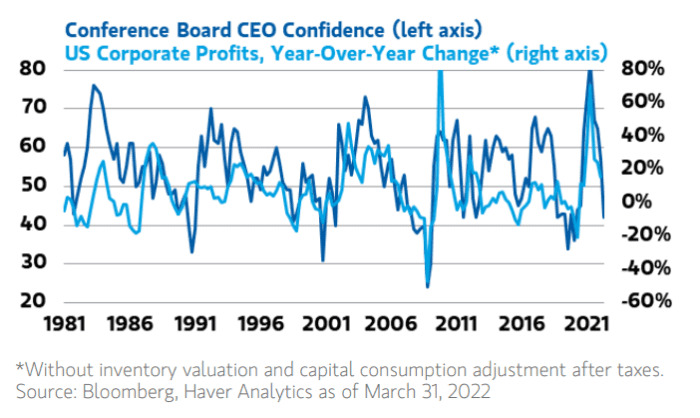

In the meantime, self confidence among chief govt officers has declined.

“The Meeting Board Measure of CEO Self confidence has not long ago suffered one particular of the steepest sequential drops in decades,” claimed Lisa Shalett, main financial commitment officer of Morgan Stanley’s prosperity-administration enterprise, in a June 13 notice. It collapsed towards 40, “a looking through which historically has coincided with revenue recessions, or damaging 12 months-about-calendar year improve in earnings.”

MORGAN STANLEY Wealth Management REPORT DATED JUNE 13, 2022

The drop in self esteem is “at odds” with the latest pattern in base-up analyst gain estimates, which have moved higher considering that January to suggest 13.5% calendar year-more than-calendar year expansion in 2022, Shalett stated in the take note. It appears to be unlikely that firms will sustain “record-significant functioning profit margins” supplied slowing GDP development, she explained.

A new survey launched Friday by the Convention Board identified that more than 60% of CEOs globally count on a economic downturn in their region in advance of the close of 2023, with 15% of main executives indicating their location is now in economic downturn.

According to Yardeni Investigate, the probability of a U.S. recession is “high,” at 45%.

Read: ‘The economy is likely to collapse,’ states Wall Road veteran Novogratz. ‘We are going to go into a genuinely quickly recession.’

“While market analysts are trimming their profit margin estimates for 2022 and 2023, the ahead gain margin rose to a file large final week,” Yardeni Analysis wrote in a take note dated June 16. “A few sectors are starting up to get pulled down by gravity: particularly, communication products and services, buyer discretionary, and client staples, even though the other individuals are continue to flying substantial.”

Crossmark’s Doll mentioned an financial economic downturn could drag the S&P 500 down below 3,600, and that the stock current market faces elevated volatility as it lacks visibility to the conclude of the Fed’s climbing cycle. The likelihood of a recession went up “a fair amount” just after the inflation reading for May possibly, he explained.

Future week traders will see clean U.S. economic data on house sales and jobless claims, as properly as readings on U.S. producing and expert services exercise.

“The window for a gentle landing is certainly narrowing,” Solloway stated. “The issue is how long it will just take for a economic downturn to materialize,” he explained, indicating his expectation is that “it’s likely to take a although,” it’s possible at least a calendar year to 18 months.

More Stories

Day Trading Domination – Tips How Day Trading Software Can Help You Dominate Stock Market

Investing Stock Market Forex Is an Exciting Trade to Learn

New Jersey Attorney Ethics Investigations – The “Ten-Day Letter”