An earlier edition of this article listed an incorrect determine for the yearly inflation level for March. The posting has been corrected.

Stock and bond traders expecting a “watershed” instant in Wednesday’s inflation data ended up still left unhappy, analysts and economists claimed, leaving open up the discussion in excess of irrespective of whether the industry is near to putting in a base.

The April buyer value index was undoubtedly hotly predicted, attracting the type of pre-launch scrutiny normally reserved for products like the month-to-month positions report. Technical analyst Jeff deGraaf, founder of Renaissance Macro Investigate, identified as it just one of the most hotly predicted CPI reading through in his more-than-30-yr occupation.

And why not? Investors were being hunting for affirmation that inflation was last but not least cooling off immediately after functioning at its hottest in extra than 40 decades — further than the vocation memory of the extensive greater part of Wall Avenue veterans.

In addition, the details was coming amid a selloff for shares and bonds which is been challenging on traders in 2022 as they fret above the Federal Reserve’s capacity to get a grip on inflation whilst averting the dreaded “hard landing” for the economic system.

Go through: Investors have not started to cost in recession: Here’s how considerably the S&P 500 could fall

Possibly proof of an inflation peak would enable steady the ship, traders may possibly have hoped, offering a clearer view on the route ahead for the Federal Reserve as it moves to jack up desire fees and shrink its stability sheet in an energy to rein in price pressures.

See: Below are 4 causes why market place volatility is not likely to subside quickly, even after U.S. inflation charge slows to 8.3%

In the conclude, the details was relatively anticlimactic. Yes, inflation slowed, with the annual pace at 8.3% versus the March reading of 8.5%. But it was continue to lots hot, and previously mentioned expectations for a looking at of 8.1%.

Additional problematic for traders was the core looking at, which strips out risky food stuff and electrical power costs. It showed a .6% every month increase compared to a Wall Road forecast for a .4% boost. The boost in the core price around the previous calendar year also slowed to 6.2% from from a 40-12 months higher of 6.5% in March.

Traders weren’t soothed. Stocks finished the working day lessen right after a round of choppy investing. The Dow Jones Industrial Average

DJIA,

fell all around 327 factors, or 1%, for its fifth straight day by day reduction. The S&P 500

SPX,

which shut at a 13-thirty day period low Monday, was off sharply, down 1.5%. The Nasdaq Composite

COMP,

which fell into a bear marketplace earlier this calendar year, slumped 3%.

Treasurys have also viewed choppy trade, but signs of an inflection level that would mark a lasting pause or a sizeable reversal in the selloff that drove yields to 3 1/2-12 months highs this month were being also missing.

“So significantly, at least, tentative proof of a peak in inflation in today’s U.S. shopper selling price index report has not been a watershed moment for U.S. govt bonds or equities,” reported John Higgins, chief marketplaces economist at Cash Economics, in a notice.

“We don’t anticipate their fortunes to make improvements to decisively until eventually soon right before the Fed stops tightening plan in summer months 2023, even as inflation drops back again further and the U.S. economic system experiences a ‘soft landing’ in the meantime,” he wrote.

The challenge, analysts and investors said, is that even though inflation may have peaked, the slowdown was not enough to make crystal clear what the Fed will have to do to get a grip on rate pressures in the months forward. The central lender very last week hiked its fed cash amount by 50 basis details, or fifty percent a percentage point, the biggest in far more than 20 yrs — generally the Fed moves in quarter-issue increments.

Fed Chairman Jerome Powell claimed 50 %-level moves have been on the desk for the next two plan conferences, but poured chilly drinking water on speculation all-around the likelihood of an even larger 75 foundation place move. Now, some analysts are penciling in the likely for a improve of tune that could put a 3-quarter-issue move again in the body.

Also study: April’s CPI report puts 75 basis stage Fed amount hikes on table at up coming few meetings, Jefferies says

“If inflation stays this hot, we expect the Fed to keep using a tricky stance on amount hikes. As we’ve found, that may be a tough pill for buyers to swallow,” mentioned Callie Cox, U.S. investment analyst at eToro, in emailed remarks.

She argued that with buyer and business demand from customers nevertheless working potent, policy makers have space to adhere a “soft landing.” But shares and crypto “may struggle to discover a bottom right until we see much more proof of the Fed’s regulate,” Cox siad. “This unique selloff could be closer to the base than the top rated. You just need to journey out the storm.”

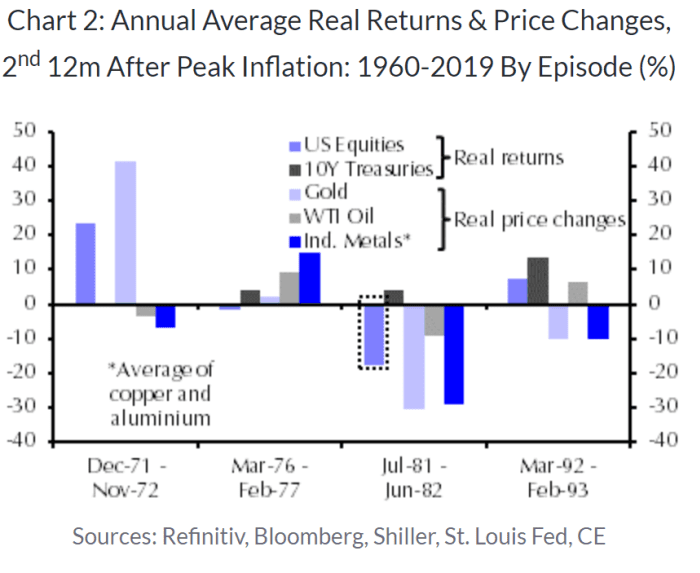

Turning to the historical history, Higgins contended that it’s much from selected stocks or bonds would change the corner even if knowledge in coming months exhibits that inflation proceeds to gradual. Their fortunes — and individuals of other property — diversified on four earlier occasions since 1960 just after large inflation in the U.S. peaked, he noted, reflecting a mixture of the Fed’s reaction, its outcome on the economic climate, and their valuations (see chart beneath).

Money Economics

The very poor overall performance of 10-12 months Treasurys in the preliminary 12 months soon after inflation peaked in 1980 coincided with the adoption of even tighter Fed policy then, Higgins said, with their generate peaking in the summer season of 1981, about the time that the federal funds fee commenced to be reduced from a peak of not significantly limited of 20% previously that spring.

“Similarly, the weak exhibiting of U.S. equities in the subsequent 12-month time period right after inflation peaked back then reflected the delayed affect of the even tighter Fed policy on the financial system, which experienced a really deep economic downturn amongst July 1981 and November 1982,” Higgins wrote.

More Stories

Day Trading Domination – Tips How Day Trading Software Can Help You Dominate Stock Market

Investing Stock Market Forex Is an Exciting Trade to Learn

New Jersey Attorney Ethics Investigations – The “Ten-Day Letter”