About the previous 3 months, 4 analysts have released their opinion on Kellogg (NYSE:K) inventory. These analysts are generally utilized by large Wall Avenue banking companies and tasked with knowing a firm’s organization to predict how a stock will trade around the approaching year.

| Bullish | Fairly Bullish | Indifferent | To some degree Bearish | Bearish | |

|---|---|---|---|---|---|

| Whole Rankings | 1 | 2 | 1 | ||

| Past 30D | 1 | ||||

| 1M Back | 1 | ||||

| 2M Back | |||||

| 3M Ago | 1 | 1 |

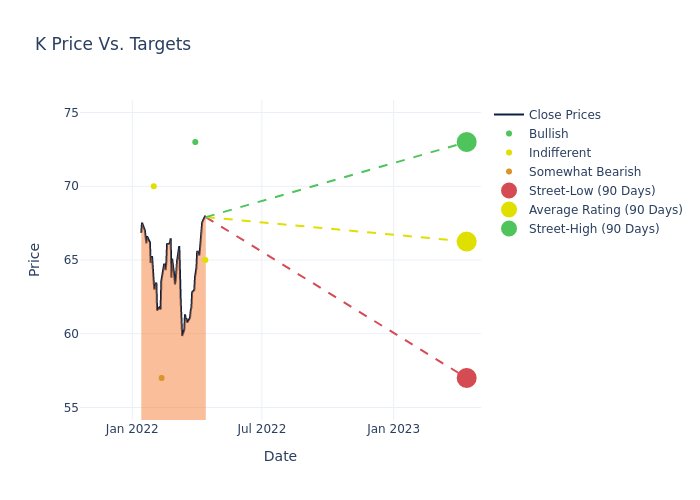

In the very last 3 months, 4 analysts have made available 12-month price tag targets for Kellogg. The organization has an regular price target of $66.25 with a superior of $73.00 and a lower of $57.00.

Beneath is a summary of how these 4 analysts rated Kellogg more than the past 3 months. The increased the number of bullish scores, the a lot more beneficial analysts are on the stock and the larger the quantity of bearish scores, the extra destructive analysts are on the stock

This average cost focus on has improved by 1.15% in excess of the previous month.

Analysts function in banking and economic systems and ordinarily focus in reporting for shares or outlined sectors. Analysts may possibly go to enterprise convention phone calls and meetings, analysis corporation economic statements, and converse with insiders to publish “analyst rankings” for shares. Analysts normally rate just about every stock when for each quarter.

Some analysts will also give forecasts for metrics like growth estimates, earnings, and income to present more guidance on shares. Buyers who use analyst ratings should really note that this specialized assistance arrives from humans and may possibly be subject matter to mistake.

This posting was produced by Benzinga’s automated written content motor and reviewed by an editor.

More Stories

Taking Business to the Next Level With Statistical Consultancy Service

Women Entrepreneurs: How To Make Your Business A Success

Requirement Analysis – Fact Finding Techniques