Will a summer rally rescue the inventory market from its relentless decrease?

Some beleaguered bulls are shifting their hopes to seasonal energy during the summer months, considering that practically nothing else appears equipped to stanch the bleeding. The S&P 500

SPX,

has fallen 16% just given that late March, even though the Nasdaq

COMP,

has fallen 22%. Each declines are unusually extreme for this kind of a shorter period of time.

My analysis provides each superior and poor news about a doable summer season rally. The great information is that, centered on historic averages by itself, the inventory current market is possible to be 7.3% greater than the place it stands now at some point this summer time. In phrases of the Dow Jones Industrial Typical

DJIA,

that is a obtain of approximately 2,300 factors.

The bad information is that there’s almost nothing unique about this opportunity. Related potentials, or increased, exist for other months of the calendar as properly.

Exactly defining the summertime rally poses a unique challenge to scientists, given that most who refer to the rally fall short to say what precisely it entails. It simply cannot be just that the stock market place will rally at some place all through the summer season, since it absolutely will —sooner or afterwards. It also will definitely decrease at some point as nicely.

To guarantee I experienced captured the best possible rally probable for the summer, I calculated the stock market’s acquire from the stop of May perhaps to its highest degree throughout the 3-month period from June 1 to Aug. 31. This gain is hypothetical, of study course, given that only in retrospect will we know when that highest degree has been hit. But it’s hard to imagine that, when applying any other definition, the summer time rally could be any larger.

I used my definition to the Dow Jones Industrial Regular again to its development in 1896. On normal, the summer months rally as so outlined measured 7.3%. Which is how substantially the marketplace will rally from the end of May perhaps to its best degree all through the coming months of June, July and August — assuming this summertime is “average.”

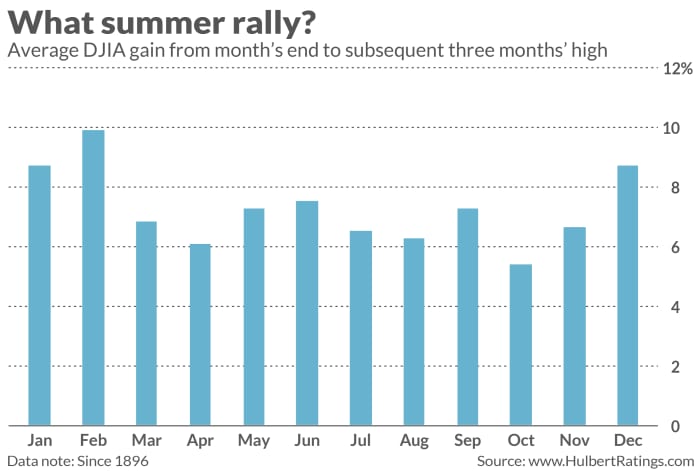

Although these kinds of a rally would be very welcome, it requires to be place in context. The accompanying chart does that by reporting the average rally opportunity for all months of the calendar when measured in the similar way. That is, for January, I calculated the achieve from the close of the thirty day period to its greatest stage in the subsequent February, March and April. For February, I measured the obtain from its finish to its highest amount in the subsequent March, April and May possibly. I did the very same for all other months as very well.

The common rally likely throughout all months is 7.3%, which is the same as it is for Could separately. 4 other months have a larger prospective (January, February, June and December), however the discrepancies between people months and the some others is not major at the 95% self-assurance amount that statisticians typically use when figuring out if a pattern is real.

From a seasonal viewpoint, in other words, the stock market’s rally probable is the identical throughout the calendar.

The bottom line? The market place will unquestionably rally at some place this summer months. But there is no seasonally dependent justification for expecting a more powerful such rally this summer season than at any other time of the calendar year. That, in convert, signifies you shouldn’t modify your current expense posture just due to the fact summer season is about to begin.

The bull sector will need to have anything robust than a summer rally to preserve it alive.

Mark Hulbert is a typical contributor to MarketWatch. His Hulbert Ratings tracks expenditure newsletters that shell out a flat price to be audited. He can be reached at [email protected].

More Stories

Day Trading Domination – Tips How Day Trading Software Can Help You Dominate Stock Market

Investing Stock Market Forex Is an Exciting Trade to Learn

New Jersey Attorney Ethics Investigations – The “Ten-Day Letter”