With its inventory down 17% about the past a few months, it is simple to disregard Wesfarmers (ASX:WES). Having said that, the company’s fundamentals glance pretty decent, and prolonged-term financials are generally aligned with long term industry value actions. Notably, we will be spending focus to Wesfarmers’ ROE currently.

ROE or return on equity is a beneficial tool to assess how successfully a company can crank out returns on the investment decision it received from its shareholders. In brief, ROE displays the earnings every single dollar generates with respect to its shareholder investments.

Perspective our newest assessment for Wesfarmers

How Do You Estimate Return On Equity?

The formula for return on fairness is:

Return on Equity = Internet Financial gain (from continuing operations) ÷ Shareholders’ Fairness

So, based on the earlier mentioned formula, the ROE for Wesfarmers is:

28% = AU$2.2b ÷ AU$7.7b (Centered on the trailing twelve months to December 2021).

The ‘return’ refers to a firm’s earnings about the previous calendar year. A single way to conceptualize this is that for every single A$1 of shareholders’ money it has, the firm produced A$.28 in profit.

What Is The Relationship In between ROE And Earnings Expansion?

So significantly, we have learned that ROE steps how effectively a corporation is creating its revenue. We now want to appraise how a lot income the corporation reinvests or “retains” for long run expansion which then gives us an plan about the progress opportunity of the organization. Assuming almost everything else continues to be unchanged, the higher the ROE and income retention, the increased the growth charge of a business when compared to corporations that don’t always bear these traits.

Wesfarmers’ Earnings Progress And 28% ROE

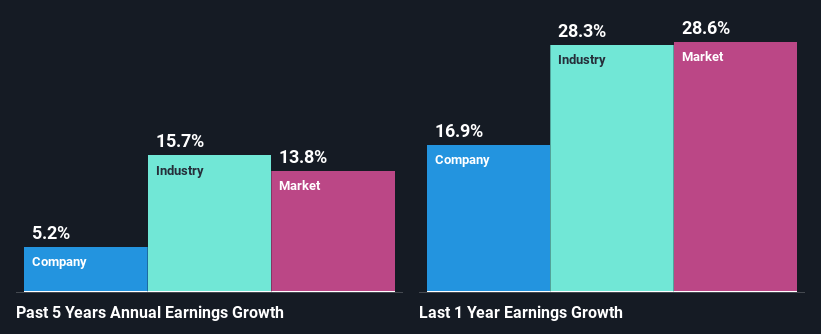

To begin with, we admit that Wesfarmers has a substantially substantial ROE. In addition, the firm’s ROE is greater as opposed to the business average of 20% which is rather extraordinary. This probably laid the groundwork for Wesfarmers’ reasonable 5.2% web income progress seen more than the earlier 5 several years.

Given that the marketplace shrunk its earnings at a level of 3.7% in the same period of time, the web cash flow growth of the firm is fairly impressive.

Earnings expansion is an crucial metric to think about when valuing a stock. What buyers will need to establish upcoming is if the envisioned earnings expansion, or the lack of it, is by now crafted into the share price. Carrying out so will support them set up if the stock’s upcoming seems to be promising or ominous. What is WES well worth right now? The intrinsic value infographic in our totally free investigation report aids visualize whether WES is presently mispriced by the current market.

Is Wesfarmers Using Its Retained Earnings Effectively?

The large a few-12 months median payout ratio of 96% (or a retention ratio of 4.4%) for Wesfarmers implies that the firm’s advancement was not definitely hampered even with it returning most of its income to its shareholders.

Besides, Wesfarmers has been shelling out dividends for at the very least 10 years or more. This displays that the firm is committed to sharing gains with its shareholders. Based on the hottest analysts’ estimates, we identified that the company’s upcoming payout ratio more than the upcoming 3 years is envisioned to maintain regular at 86%. Consequently, the firm’s long run ROE is also not predicted to alter by a great deal with analysts predicting an ROE of 31%.

Summary

On the whole, we do sense that Wesfarmers has some favourable characteristics. Particularly the advancement in earnings which was backed by an outstanding ROE. Nonetheless, the substantial ROE could have been even extra advantageous to investors experienced the company been reinvesting extra of its income. As highlighted earlier, the latest reinvestment rate seems to be negligible. With that claimed, the most current marketplace analyst forecasts expose that the firm’s earnings are predicted to speed up. Are these analysts expectations based mostly on the broad anticipations for the sector, or on the company’s fundamentals? Click on right here to be taken to our analyst’s forecasts web site for the enterprise.

Have responses on this article? Anxious about the material? Get in contact with us instantly. Alternatively, e-mail editorial-team (at) simplywallst.com.

This report by Simply just Wall St is standard in nature. We provide commentary dependent on historic information and analyst forecasts only applying an impartial methodology and our content articles are not supposed to be economic suggestions. It does not represent a recommendation to obtain or sell any inventory, and does not consider account of your targets, or your fiscal condition. We goal to deliver you very long-expression concentrated evaluation pushed by basic data. Be aware that our analysis may possibly not factor in the hottest selling price-sensitive firm bulletins or qualitative substance. Just Wall St has no place in any stocks pointed out.

More Stories

Investing Stock Market Forex Is an Exciting Trade to Learn

New Jersey Attorney Ethics Investigations – The “Ten-Day Letter”

Five Tips For Dealing In the Stock Market