By now, we all know the litany of market woes and headwinds: inflation, which has been grabbing all the headlines the Fed’s transform to rate hikes and financial tightening in response to inflation the ongoing checklist of interconnected concerns, together with supply chain tangles, the Russia-Ukraine war, high oil price ranges.

Latest information and market stats have only bolstered the small-expression gloom. Q1 showed a GDP decline of 1.6%, and preliminary knowledge reveals a similar decline for Q2, which would place the US into a recession. But do the present clouded conditions suggest that investors have to absolutely back again absent from the bulls?

Weighing in from Oppenheimer, main financial investment strategist John Stoltzfus doesn’t back again away from striving to square that circle. Acknowledging and examining today’s industry surroundings, Stoltzfus confronts it head on, crafting, “Even in the confront of uncertainty and palpable hazards of recession, our for a longer period-phrase outlook for the U.S. economic system and the stock industry stays decidedly bullish. We believe that U.S. financial fundamentals continue to be on stable footing. U.S. development need to keep on being effectively supported by client, expense and governing administration investing.”

Having Stoltzfus’ outlook and turning it into concrete suggestions, the pros at Oppenheimer are offering two stocks a thumbs up. In actuality, the firm’s analysts see more than 50% upside probable in store for each individual. We used TipRanks’ databases to obtain out what the rest of the Avenue has to say.

Vertex Strength (VTNR)

First up is Vertex, a transitional energy enterprise with a aim on the output and distribution of both equally typical and option fuels. The corporation owns roughly 3.2 million barrels well worth of storage capability, as nicely as an oil refinery in Cell, Alabama capable of creating 91,000 barrels for each day of refined gas. Vertex is a essential provider of base oils for the North American lubricant field, and is one of the major processors of utilized motor oil in the US marketplace.

The Cellular refining facility is a person of the keys to knowing Vertex Energy’s recent placement. The enterprise obtained the refinery from Shell Oil, in a transaction that was concluded in April of this year. Vertex paid $75 million in funds plus $25 million in other funds expenditures. Together with the refinery, Vertex obtained a hydrocarbon inventory well worth $165 million, financed in a different settlement. This acquisition is a major progress in Vertex’s refining capabilities, and puts the company in place to start renewable diesel fuel production in 1Q23. The Mobile refinery managed regular functions through the late winter and early spring, when the transfer of ownership was progressing.

Also in the first quarter of this yr, Vertex saw its major line income mature yr-above-year, from $25.05 million to $40.22 million, a gain of 60%. Earnings, even so, slipped, from a 1-cent get for every diluted share in the year-in the past quarter to an 8-cent decline in the 1Q22 report. Despite the loss, Vertex was equipped to enhance its income holdings year-more than-calendar year by close to a component of 10, from $12.52 million to $124.54 million.

In a person other extremely good announcement made in modern weeks, Vertex in June entered the Russell 3000 stock index.

Noah Kaye, a 5-star analyst with Oppenheimer, sees almost everything going proper for Vertex at this minute, and writes of the enterprise: “Vertex is at the moment encountering a ‘blue-sky scenario’ on the Mobile acquisition. The enterprise is undertaking a comparatively minimal-charge renewable diesel capital undertaking at Mobile while intending to carry on creating largely typical fuels. When attentive to execution possibility and spread compression, and looking at issues all around the platform’s strategic foreseeable future, we foresee a stage-alter in profitability to empower adaptability for Vertex’s future growth.”

Viewing this stock as an motor for progress going ahead, Kaye prices it an Outperform (i.e. Acquire), and sets a rate target of $18 to advise a a single-calendar year upside of ~52%. (To check out Kaye’s monitor file, click on below)

All round, it is crystal clear from the unanimous Sturdy Acquire consensus that Wall Avenue likes what it sees in VTNR. The inventory is at present trading for $11.87 and its $22.50 common focus on implies ~90% upside possible from that degree. (See VTNR stock forecast on TipRanks)

Lumos Pharma (LUMO)

We’ll shift our target now to the biopharma sector, exactly where Lumos is functioning on new therapies for unusual health conditions, via safer and more successful orally dosed advancement hormone stimulation treatments. The company’s lone drug candidate, LUM-201, is below investigation in clinical trials as a treatment for pediatric advancement hormone deficiency (PGHD), a major affliction that can lead to troubles in adult life. Current treatment options for PGHD entail frequent injections more than a span of several years Lumos’s orally dosed alternative, if it gets acceptance from the Fda, will stand for a new alternative for patients.

At the moment, LUM-201 is undergoing several human scientific trials, analyzing its prospective. The foremost demo, the Period 2 OraGrowtH210 examine, has reportedly achieved the 50% randomization milestone. Interim assessment of this demo is antici

pated just before the close of this yr, with primary final result facts predicted for launch in 2H23. The other sophisticated trials, the PK/PD trial, or OraGrowtH212, is expected to show interim data evaluation later on this year.

Two other trials are at earlier levels. OraGrowth211 is a proposed long-term extension of this demo sequence, and the OraGrowtH213 demo is a change analyze which has been initiated to examine shifting LUM-201 sufferers from the rhGH arm of the OraGrowtH210 review.

Altogether, the knowledge from these research persuaded the Food and drug administration in May well to carry a partial scientific keep which had been imposed on Lumos’s trial application. The hold was place in spot previous summer season, and limited the scientific trials to a 12-month period. With it lifted, Lumos will be equipped to done a lot more extended research, and to initiate new, extended-expression medical trials of LUM-201. The business has designs to conduct the OraGrowtH210 study around a expression of 24 months, and to prolong period of the OraGrowtH212 research.

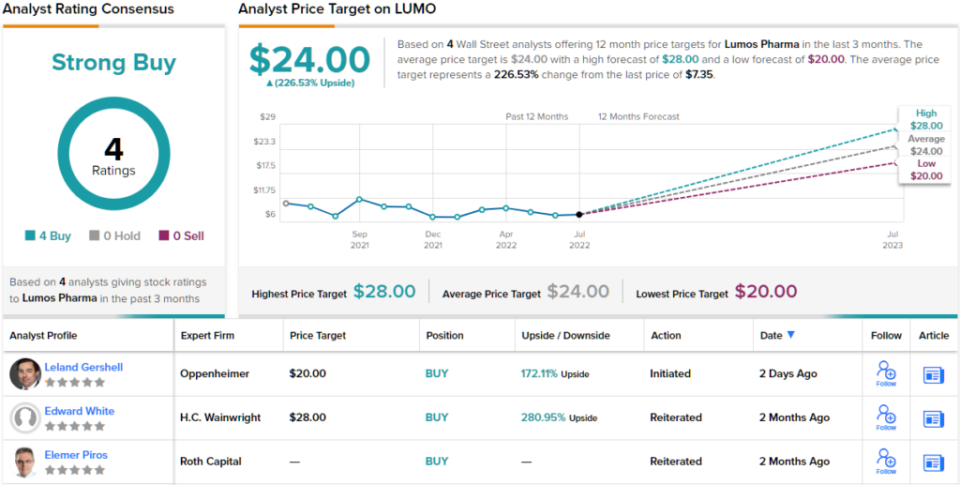

All in all, this company’s situation, with a reliable drug prospect prospect in a discipline with a higher clinical need to have, prompted Oppenheimer’s Leland Gershell to initiate his protection of the stock with an Outperform (i.e. Buy) ranking.

Backing his stance, Gershell wrote, “LUMO is positioned to transform the therapy landscape for diseases stemming from advancement hormone deficiency (GHD) by the likely introduction of a each day oral medication… We glimpse ahead to a Phase 2 interim evaluation as effectively as PK/PD information as important catalysts towards 12 months-conclude, for which methods give enough runway. With shares buying and selling at ~hard cash amounts, we propose buyers construct a position.”

Looking ahead, Gershell sets a $20 value goal on LUMO shares, implying an upside of 172% on the just one-calendar year time body. (To observe Gershell’s observe report, click listed here)

The unanimous Robust Buy consensus rating on this biopharma stock is based mostly on 4 latest optimistic analyst testimonials. LUMO is buying and selling for $7.35 and its $24 typical selling price concentrate on implies room for a robust 226% achieve from current degrees. (See Lumos stock forecast on TipRanks)

To obtain very good strategies for shares buying and selling at interesting valuations, pay a visit to TipRanks’ Finest Shares to Purchase, a recently introduced tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this posting are exclusively individuals of the highlighted analysts. The articles is meant to be employed for informational purposes only. It is incredibly essential to do your very own examination ahead of earning any financial investment.

More Stories

Five Tips For Dealing In the Stock Market

How To Learn Stock Investing – It’s Easier Than You Think

BSE (Bombay Stock Exchange) – Online Trading System