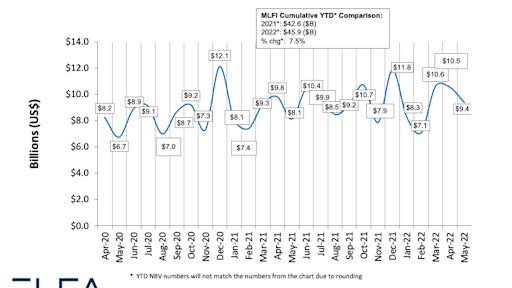

The Equipment Leasing and Finance Association’s (ELFA) Month to month Leasing and Finance Index showed overall new organization quantity for May perhaps was $9.4 billion, up 16% calendar year-over-year from new company volume in May well 2021.

ELFA

The Equipment Leasing and Finance Association (ELFA) has produced its Month to month Leasing and Finance Index for May possibly.

The index, which experiences financial exercise based on suggestions from 25 firms within the tools finance sector, was $9.4 billion, up 16% calendar year-more than-year from new organization quantity in May 2021. Volume was down 10% from $10.5 billion in April. Year-to-date, cumulative new small business volume was up virtually 8% when compared to 2021.

“May action for MLFI-25 gear finance organization members shows sturdy origination volume and quite secure credit score quality metrics,” stated Ralph Petta, ELFA president and CEO. “The economic climate continues to provide employment and corporate The united states, in normal, studies sturdy stability sheets—all in the facial area of a waning overall health pandemic. Offsetting this superior news is superior inflation, generating havoc for lots of people, and ongoing offer chain disruptions and higher fascination premiums, which are squeezing much of the company sector. As a final result, lots of machines finance providers tactic the summer months with guarded optimism.”

Receivables ended up 1.6%, down from 2.1% the prior month and down from 1.9% in the exact interval in 2021. Cost-offs have been .12%, up from .05% the prior thirty day period and down from .30% in the year-before time period.

Credit approvals totaled 76.8%, down from 77.4% in April. Complete headcount for gear finance providers was down 3% year-in excess of-calendar year.

The Equipment Leasing & Finance Foundation’s Month-to-month Self confidence Index (MCI-EFI) in June is 50.9, an boost from 49.6 in Could.

More Stories

Career Counselling – Finding a Career Suited to Your Personality

New Small Business Loans Starter Guide: What Are Your Options for Financing As a New Business Owner?

Career Guidance and Career Advice for Graduates